As the Maine legislature considers a state law to create an hourly overtime standard for farmworkers, as well as to provide organizing and collective bargaining rights to farmworkers, I am writing to provide you testimony in support of LD 398. My testimony is based on some key indicators related to farm labor and employment in California, because of the state’s experience in implementing a phased-in hourly overtime standard for farmworkers that will eventually require that all farmworkers be paid overtime after 8 hours per day or 40 hours per week. In sum, I urge the legislature to pass legislation that establishes an overtime threshold in Maine at 40 hours per week.

I have researched and written about farm labor issues, including wages, labor standards, and worksite enforcement, for over 12 years at the Economic Policy Institute (EPI). Some of my past reports are included in the footnotes of this testimony. I am also a Visiting Scholar with the Global Migration Center at the University of California, Davis—a university located in California’s agricultural heartland, the Central Valley.

Despite numerous claims being made by agribusiness representatives over the years that requiring overtime pay for farmworkers will negatively impact the agricultural industry, there is virtually no credible evidence to support such claims, and certainly no “smoking gun” evidence suggesting that overtime pay for farmworkers after 40 hours per week will hurt the industry or slash profits dramatically. In fact, the limited available evidence that does exist regarding the impact of overtime pay on the agricultural industry in California, strongly suggests that is not the case. In other words, data on agricultural employment and wages in California suggest that overtime pay for farmworkers has not corresponded with any major impacts or shocks to the California farm economy or labor market.

This testimony will present some of the relevant information about these realities, which suggests that overtime pay for farmworkers in Maine after 40 hours per week will not lead to the negative outcomes that agribusiness representatives may claim—largely without evidence—will result.

Farmworkers are a precarious workforce, with few rights or access to justice

The coronavirus pandemic and the ensuing economic collapse was a difficult time for many workers and families, with hundreds of thousands of deaths and widespread human suffering. While millions of workers were allowed to remain home and work remotely in order to stay safe, the vast majority of workers did not have a remote work option, either because employers did not permit it or because it was simply not feasible.1 One key segment of the workforce that was expected to keep working in order to sustain the food supply chain—but at great risk to themselves and their families—were farmworkers.

Even before the pandemic, farmworkers were employed in one of the most hazardous jobs in the entire U.S. labor market,2 and as EPI research has shown, they suffer very high rates of wage and hour violations.3 While the number of wage and hour inspections by the U.S. Department of Labor recently dropped to the lowest level ever, just 879 in fiscal year 2022,4 which is fewer than 75 inspections per month in agriculture, the vast majority of those investigations—70%–detect violations.5 The low number of inspections means that there’s roughly a 1% chance that any agricultural employer in the United States will ever be investigated in a given year, and may therefore reasonably assume that they can violate wage and hour laws with impunity.6 As a result, it is even more important to have robust labor standards in place for farmworkers and to increase enforcement—but also provide organizing and collective bargaining rights to farmworkers, as the Committee is also considering—which would help ensure that farmworkers are paid fairly for every hour that they work.

In addition, most farmworkers in the United States either lack an immigration status or are employed via a precarious, temporary status through the H-2A visa program. The lack of an immigration status, or having only a temporary status, means that unauthorized and H-2A farmworkers are even worse off because they have limited labor rights, which increases their vulnerability to wage theft and other abuses.7

Unauthorized immigrants who speak up about unfair treatment or abuse in the workplace risk employer retaliation in the form of deportation. In the case of temporary migrant farmworkers employed though the H-2A visa program, H-2A workers are not permitted to change employers and are thus practically indentured to them.8 The half of farmworkers who are unauthorized plus roughly 10% of farmworkers with H-2A visas mean that only 40% of the farm workforce are U.S. citizens and legal immigrants with full rights and agency in the labor market. Having the majority of the farm workforce employed without basic workplace rights in turn puts downward pressure on labor standards for all workers and has helped to keep wages low in agriculture for decades.

Farmworkers provide an essential service but are underpaid

As EPI research has also demonstrated, farmworkers are among the lowest-paid workers in the entire U.S. workforce, even lower than other comparable low-wage workers. As Figure A shows, nationwide, farmworkers earned just $16.62 per hour on average in 2022. The farmworker wage of $16.62 per hour is roughly half (52%) of the average hourly wage for all workers in 2022, which stood at $32 per hour. Production and nonsupervisory nonfarm workers, who are the most appropriate cohort of workers outside of agriculture to compare with farmworkers,9 earned an average hourly wage of $27.56 nationwide in 2022. In other words, farmworkers earned 60%—or just three fifths—of what comparable workers outside of agriculture earned in 2022.

The farmworker wage gap in 2022: Farmworkers earn very low wages compared with other workers: Average hourly wage rate for nonsupervisory farmworkers nationwide and H-2A farmworkers in Maine compared with average hourly wages of other workers, 2022

| Type | Amount | |

|---|---|---|

| H-2A farmworkers in Maine (AEWR) | $15.66 | |

| Nonsupervisory farmworkers | $16.62 | |

| Workers with less than HS | $16.52 | |

| Workers with HS diploma only | $21.94 | |

| Nonsupervisory nonfarm | $27.56 | |

| All workers | $32.00 | |

Notes: All values are for 2022 and in 2022 dollars. HS = high school. H-2A wage reflects the Adverse Effect Wage Rate set by the Department of Labor for fiscal year 2022 for migrant farmworkers working in H-2A status in the state of Maine. Nonsupervisory nonfarm workers’ wage represents the average hourly earnings of production and nonsupervisory employees, total for the private sector, not seasonally adjusted. Nonsupervisory farmworkers’ wage is the gross average hourly wage of field and livestock workers. Data for all workers, and for workers with a high school diploma and less than high school, can be found at the Economic Policy Institute State of Working America Data Library.

Source: Author’s analysis of USDA Farm Labor Survey data and nonfarm wage data from the BLS Current Employment Statistics survey; EPI analysis of CPI-ORG microdata; Employment and Training Administration, U.S. Department of Labor, Labor Certification Process for the Temporary Employment of Foreign Workers in Agriculture in the United States: Adverse Effect Wage Rates for Non-Range Occupations in 2022, 86 Fed. Reg. 71282 (December 15, 2021).

Farmworkers have very low levels of educational attainment, and thus Figure A compares their earnings to the two groups of workers with the lowest levels of education in the United States, those without a high school diploma and those with only a high school diploma. Figure A also shows that farmworkers at $16.62 per hour earned almost exactly the same average hourly wage earned by all workers without a high school diploma ($16.52), and farmworkers earned $5.32 less per hour than the average wage earned by all workers with only a high school diploma, who earned $21.94 per hour.

The H-2A program is a work visa program that allows farm employers to hire migrant workers temporarily if they anticipate a shortage of U.S. workers to fill temporary and seasonal jobs. In 2022, more than 300,000 H-2A workers were employed in the United States, working jobs that lasted an average of six months. Those H-2A workers represented roughly 10-15% of all farmworkers in the United States. In Maine, U.S. the Department of Labor certified 1,304 jobs to be filled with H-2A workers.10

Many of the farmworkers employed through the H-2A visa program in Maine earned even lower wages than those of other farmworkers in 2022. Figure A shows that the minimum required wage that must be paid to most farmworkers with H-2A visas in Maine—known as the Adverse Effect Wage Rate (AEWR)—was set by the U.S. Department of Labor at $15.66 per hour. At $15.56 per hour, H-2A workers in Maine were paid less than the average that farmworkers earned nationwide, and less than H-2A workers in 14 other states.11

These data show that the claim which is often made and repeated by farm employers and agribusiness lobbyists and representatives—i.e., that wages for farmworkers are too high and unsustainable for employers—is not credible and not based on any data or evidence, since the wages of farmworkers continue to be some of the lowest wages in the entire U.S. labor market.

Overtime protections for farmworkers in California: Current law requires overtime pay after 8 hours per day or 40 hours per week for farms with 26 or more employees, while smaller farms are still being phased in to the same standard

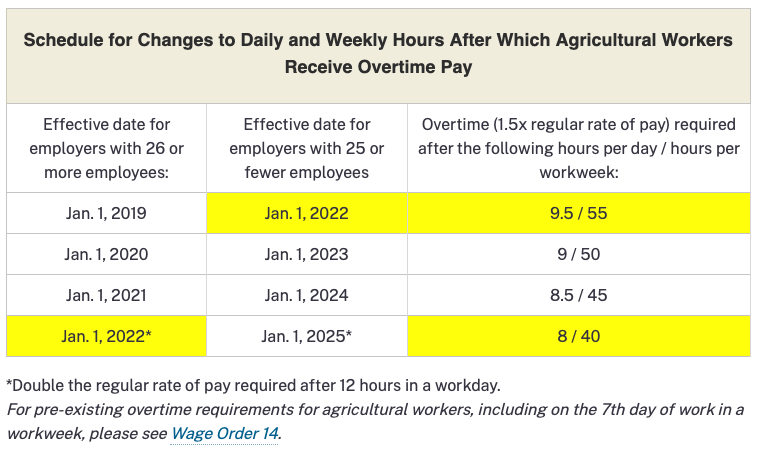

California’s Assembly Bill (AB) 1066 (2016) created a timetable for workers employed in agriculture to receive overtime pay on the same basis as workers in most other industries—in other words, time and a half after 8 hours per day or 40 hours per week—but AB 1066 created a specified phase-in period so that employers could have time to adjust to the new rules. The law specifies that farmworkers employed on farms with 26 or more employees would gradually receive overtime pay between January 1, 2019 and January 1, 2022, based on a declining threshold of hours worked, eventually requiring time and a half after 8 hours per day or 40 hours per week in the fourth year after the phase-in period begins. Farms with 25 or fewer employees are subject to a delayed phase-in period, beginning on January 1, 2022 and ending on January 1, 2025 (meaning all employers of all sizes must pay time and a half after 8 hours per day or 40 hours per week beginning on January 1, 2025).

The preamble to AB 1066 summarizes the updated overtime rule for farmworkers:

This bill would remove the exemption for agricultural employees regarding hours, meal breaks, and other working conditions, including specified wage requirements, and would create a schedule that would phase in overtime requirements for agricultural workers, as defined, over the course of 4 years, from 2019 to 2022, inclusive. Beginning January 1, 2022, the bill would require any work performed by a person, employed in an agricultural occupation, in excess of 12 hours in one day to be compensated at the rate of no less than twice the employee’s regular rate of pay. The bill would provide employers who employ 25 or fewer employees an additional 3 years to comply with the phasing in of these overtime requirements.12

The hours worked per day or per week before farmworkers are eligible for overtime pay, i.e. at a rate of one and one-half times the employee’s regular rate of pay, is phasing-in according to the schedule shown in Figure B, which comes from the Labor Commissioner’s Office in the California Department of Industrial relations.

Overtime for California farmworkers on farms with 26 or more employees was phased-in between 2019 and 2022: Smaller farms phased-in between 2022 and 2025

Notes: The image in this figure is a copy of the original, created by the California Department of Industrial Relations (see Source).

Source: Labor Commissioner's Office, "Overtime for Agricultural Workers," California Department of Industrial Relations, updated January 2022.

For the past four and a quarter years, farmworkers employed on farms with 26 or more employees in California have been entitled to overtime pay. On January 1, 2022, those workers became entitled to overtime pay on par with the overtime threshold in other industries, after 8 hours per day or 40 per week. In addition, as shown in Figure B, on that date, those same farmworkers who work more than 12 hours in one day must now be paid twice the amount of their regular rate of pay after the 12th hour.

The phase-in period for farm employers with 25 or fewer employees began on January 1, 2022, and now requires those employers to pay time and a half overtime to farmworkers who work more than 9 hours in a day or 50 hours in a week (since January 1, 2023).

Due to gaps in available public data, it is impossible to know the share of employers in California who are now required to pay the full overtime rate of 8 hours per day or 40 hours per week. Data from the Quarterly Census of Employment and Wages (QCEW) from the Bureau of Labor Statistics, as well as the Farm Labor Survey (FLS) from the U.S. Department of Agriculture (USDA), provide statistics on the number of agricultural establishments by number of employees, but only at the national level. The Census of Agriculture (COA) from 2017 is somewhat outdated now, but nevertheless contains one table listing the number of farms by number of hired workers. However, the largest denomination of workers in the COA data is 10, making it impossible to know how many farms hire 25 or fewer workers or 26 or more workers, the employee threshold set in the AB 1066.13

National-level data from the FLS and QCEW suggest that anywhere between one-third and half of farms in the United States employ 26 or more workers.14 If we apply those shares to California, and assume that one-third to one-half of California’s farms employ 26 or more workers, that means that somewhere between 5,600 to 8,500 of California’s roughly 17,000 farms15 have been required to pay overtime since 2019 and are now paying their employees time and a half after they have worked 8 hours per day or 40 hours per week.

California’s farm economy and labor market indicators have held steady since implementation of the state requirement that farmworkers be paid overtime

While there is limited available evidence regarding the impact of overtime pay in agriculture, basic data on the agricultural economy in the nation’s biggest and most important farm state—California—strongly suggests that overtime pay for farmworkers has not corresponded with any negative impacts or shocks to the California farm economy or labor market. This section discusses three key indicators.

1. Average hours worked by farmworkers in California have remained constant during the overtime phase-in period

The U.S. Department of Agriculture’s (USDA) Farm Labor Survey (FLS)16 provides an important source of information on wages paid to U.S. farmworkers and hours worked by them. Data published by USDA on the average of hours worked per week by farmworkers on California farms—before and after enactment and implementation of the AB 1066 farmworker overtime law—shows that the number of hours worked remained relatively constant, dropping on average by just over one hour in the years since the implementation of AB 1066.

Table 1 shows that between 2014 and 2018, the five years preceding the overtime phase-in period mandated by AB 1066, California’s farmworkers worked an average of 42.8 hours per week. In the four years that AB 1066’s overtime provisions have been in effect, farmworkers worked an average of 41.6 hours per week, which amounts to 1.2 fewer hours per week as compared to the five preceding years before implementation of AB 1066. In fact, average weekly hours have declined in every year since 2019.

Thus, in the five years before AB 1066’s phased-in overtime provisions went into effect, as well as during the four years of 2019 to 2022, when the phased-in overtime law was in effect, hours worked have declined modestly, suggesting that California’s overtime pay requirement has not correlated with a drastic change in the number of hours worked by California’s farmworkers. In 2022, California’s farmworkers worked an average of 40.5 hours per week, which means that many farm employers in California are likely to be paying very few hours of overtime pay to their farmworker employees, if any.

Average weekly work hours for California farmworkers declined modestly after implementation of state overtime law

| Year | Hours worked per week |

|---|---|

| 2014 | 42.8 |

| 2015 | 42.7 |

| 2016 | 43.3 |

| 2017 | 42.8 |

| 2018 | 42.6 |

| 2019 | 43.1 |

| 2020 | 41.5 |

| 2021 | 41.3 |

| 2022 | 40.5 |

| Average hours worked per week, 2014-18 | 42.8 |

| Average hours worked per week, 2019-22 | 41.6 |

Source: Author's analysis of National Agricultural Statistics Service, "Annual Average Number of Hired Workers and Gross Hours Worked – Regions and United States," Farm Labor survey reports, reports from years 2014-2022.

A caveat about the USDA data is that the averages reported for hours worked do not provide enough context about the wide variation in hours worked by farmworkers, in terms of individual crops or commodities, and especially during peak harvest times. In addition, the USDA data also exclude workers employed by farm labor contractors and other crop support businesses that bring workers to farms. But the data at least provides a baseline of information showing that there have been no major shifts in terms of the average weekly hours worked in California.

2. Total wages paid by agricultural employers to farmworkers in California increased more slowly after passage of California’s agricultural overtime law

Data from QCEW from the Bureau of Labor Statistics shows that in California, total wages paid by employers have not increased at a rapid or extraordinary rate since the implementation of the phased-in overtime law. This counters the claim that agribusiness representatives might make with respect to wages; i.e., if they note concerns that wages paid to farmworkers will increase rapidly because of laws that require overtime pay of time and a half for farmworkers. In fact, the total amount of wages paid by agricultural employers has grown at a slower rate in California as compared to the years that preceded the implementation of AB 1066. Table 2 shows the total wages paid by agricultural employers in California under the North American Industry Classification System (NAICS) code 11 for Agriculture, between 2014 and 2021, all of which have been adjusted for inflation to constant 2022 dollars.

Total wages paid by agricultural employers in California grew more slowly after state overtime law implemented: Total wages paid by agricultural employers in California (in thousands), 2014-2021

| Year | Annual wages |

|---|---|

| 2014 | $14,777,968 |

| 2015 | $15,757,314 |

| 2016 | $16,704,788 |

| 2017 | $16,764,272 |

| 2018 | $17,026,675 |

| 2019 | $17,542,269 |

| 2020 | $18,139,858 |

| 2021 | $18,104,709 |

| Average annual increase in total wages paid, 2014–18 | 3.8% |

| Average annual increase in total wages paid, 2018–21 | 2.1% |

Note: All values have been adjusted for inflation to constant 2022 dollars using the CPI-U-RS.

Source: Author's analysis of Quarterly Census of Employment and Wages, Total Wages (in thousands) in Private NAICS 11 Agriculture, forestry, fishing and hunting for All establishment sizes in California -- Statewide. Series ID: ENU0600030511.

According to QCEW data, in the five years leading up to beginning of the overtime phase-in period required by AB 1066 (2014-18), total wages paid increased by an average of 3.8% per year. When considering the year immediately before AB 1066’s overtime provisions went into effect (2018) through the third full year of AB 1066’s overtime phase-in (2021), wages increased on average by only 2.1%, significantly lower than the rate of increase before the law. The main takeaway is that the amount of total wages paid by agricultural employers does not appear to have been impacted by the overtime pay requirement.

3. The number of agricultural establishments in California remained constant after AB 1066’s overtime provisions took effect

According to QCEW data, the number of agricultural establishments in California has remained constant over the past dozen years. Agribusiness representatives may claim that agricultural establishments in Maine will be forced to close or will decide to move their operations to other U.S. states because of higher labor costs associated with farmworkers being entitled to overtime pay. But in California, this has not been the case: enactment of AB 1066 and the overtime phase-in period which began in 2019 has not correlated with a decline in agricultural establishments.

Table 3 shows that, according to the most recent available data, the number of agricultural establishments in the third quarter of 2022 was 16,875, which is 203 more establishments than in 2011. The number of agricultural establishments in 2018—the year before AB 1066’s overtime provisions took effect—was 16,812. In 2021, three full years after AB 1066’s overtime phase-in, the number of agricultural establishments in California rose to 16,878, an increase of 66 establishments.17

Number of agricultural establishments in California held steady since implementation of overtime pay for farmworkers

| Year | Number of agricultural establishments |

|---|---|

| 2011 | 16,672 |

| 2012 | 16,516 |

| 2013 | 16,500 |

| 2014 | 16,610 |

| 2015 | 16,408 |

| 2016 | 16,150 |

| 2017 | 16,252 |

| 2018 | 16,812 |

| 2019 | 16,866 |

| 2020 | 16,840 |

| 2021 | 16,878 |

| 2022 (Q3) | 16,875 |

Note: Annual average as reported by QCEW. Data for 2022 are preliminary and only for the third quarter of 2022 (Q3).

Source: Author's analysis of Quarterly Census of Employment and Wages, Number of Establishments in Private NAICS 11 Agriculture, forestry, fishing and hunting for All establishment sizes in California -- Statewide, NSA. Series ID: ENU0600020511.

Conclusion: Maine should provide equal rights to farmworkers by making them eligible for overtime pay after 40 hours per week

The historical injustices that have intentionally excluded farmworkers from basic worker protections and prevented them from being treated and paid fairly—according to labor standards that are on par with workers in other industries—are a stain on America’s history, one that continues to endure despite mountains of evidence proving that they are unjustified and irrational. The Maine legislature has an opportunity to right this wrong, by passing legislation that will make farmworkers eligible for overtime pay after 40 hours per week.

Thank you for your consideration.

Daniel Costa, Esq.

Director of Immigration Law and Policy Research

Economic Policy Institute

Notes

1. Elise Gould and Heidi Shierholz, “Not everybody can work from home: Black and Hispanic workers are much less likely to be able to telework,” Working Economics blog (Economic Policy Institute), March 19, 2020.

2. U.S. Bureau of Labor Statistics, “Table 1. Incidence rates of nonfatal occupational injuries and illnesses by industry and case types, 2021,” in Injuries, Illnesses, and Fatalities, U.S. Department of Labor.

3. Daniel Costa, Philip Martin, and Zachariah Rutledge, Federal labor standards enforcement in agriculture: Data reveal the biggest violators and raise new questions about how to improve and target efforts to protect farmworkers, Economic Policy Institute, December 15, 2020.

4. U.S. Department of Labor, Wage and Hour Division, Agriculture data table.

5. Daniel Costa, Philip Martin, and Zachariah Rutledge, Federal labor standards enforcement in agriculture: Data reveal the biggest violators and raise new questions about how to improve and target efforts to protect farmworkers, Economic Policy Institute, December 15, 2020.

6. Daniel Costa, Philip Martin, and Zachariah Rutledge, Federal labor standards enforcement in agriculture: Data reveal the biggest violators and raise new questions about how to improve and target efforts to protect farmworkers, Economic Policy Institute, December 15, 2020.

7. See, for example, David Cooper and Teresa Kroeger, Employers steal billions from workers’ paychecks each year: Survey data show millions of workers are paid less than the minimum wage, at significant cost to taxpayers and state economies, Economic Policy Institute, May 10, 2017; Annette Bernhardt, Ruth Milkman, et al., Broken Laws, Unprotected Workers: Violations of Employment and Labor Laws in America’s Cities, Center for Urban Economic Development, National Employment Law Project, and UCLA Institute for Research on Labor and Employment, 2009; Centro de los Derechos del Migrante, Ripe for Reform: Abuses of Agricultural Workers in the H-2A Visa Program, April 2020.

8. See, for example, Tina Vasquez, “Human trafficking or a guest worker program? H-2A’s systemic issues result in catastrophic violations,” Prism, April 14, 2023; Latino USA, “Head Down: Part I,” podcast, April 14, 2023; Mary Bauer and Meredith Stewart, Close to Slavery: Guestworker Programs in the United States, Southern Poverty Law Center, February 19, 2013; Centro de los Derechos del Migrante, Ripe for Reform: Abuses of Agricultural Workers in the H-2A Visa Program, April 2020.

9. See discussion in Daniel Costa, “The farmworker wage gap continued in 2020: Farmworkers and H-2A workers earned very low wages during the pandemic, even compared with other low-wage workers,” Working Economics blog (Economic Policy Institute), July 20, 2021. For previous years comparing farmworkers with production and nonsupervisory nonfarm workers, see Economic Research Service, “Wages of Hired Farmworkers” in “Farm Labor,” U.S. Department of Agriculture, last updated March 22, 2023.

10. Author’s analysis of Office of Foreign Labor Certification, Employment and Training Administration, Performance Data, U.S. Department of Labor [accessed April 17, 2023].

11. Employment and Training Administration, U.S. Department of Labor, Labor Certification Process for the Temporary Employment of Foreign Workers in Agriculture in the United States: Adverse Effect Wage Rates for Non-Range Occupations in 2022, 86 Fed. Reg. 71282 (December 15, 2021).

12. AB-1066, Agricultural workers: wages, hours, and working conditions (2015–2016). From California Legislative Information website.

13. National Agricultural Statistics Service, “Table 7. Hired Farm Labor – Workers and Payroll: 2017” (listed by U.S. state), in 2017 Census of Agriculture, U.S. Department of Agriculture.

14. See Tables 1 and 2 in Daniel Costa and Philip Martin, “Nine in 10 farmworkers could be covered by the paid leave provisions of the Families First Coronavirus Response Act—but not if smaller employers are exempted,” Working Economics Blog (Economic Policy Institute), citing QCEW and Farm Labor Survey data.

15. For the number of agricultural establishments in California, see Table 3 in this testimony.

16. National Agricultural Statistics Service, Farm Labor survey reports, U.S. Department of Agriculture (various quarters).

17. Quarterly Census of Employment and Wages, Number of Establishments in Private NAICS 11 Agriculture, forestry, fishing and hunting for All establishment sizes in California — Statewide. Series ID: ENU0600020511. Data cited in text for 2022 are preliminary and only for the third quarter of 2022 (Q3).